Get Started With

servzone

Overview

is the number of business operations that go through measurements and weights for better performance. Thus the government has introduced an act to resolve this issue “Legal Metrology Act”. The purpose of this act is to keep transparency and clarity in the business, the act also protects the right of the consumer.

The Legal Metrology Act helps to manage and minimize the side effects of weight and measurement errors. Clearly defines measuring and measuring equipment, units, standards, and mandatory requirements aimed at ensuring public guarantees from the standpoint of weight and accuracy safety. and measurements.

Legal Metrology Act, 2009, was implemented with effect from 1st April 2011, contains the following preamble:

“An act to establish and enforce standards of weights and measures, regulate trade and commerce in weights, measures and other goods which are sold or distributed by weights, measure or number and for matters connected therewith or incidental thereto.”

Legal Metrology Standards in India are defined and implemented by the government of India, Department of Consumer Affairs under Ministry of Consumer Affairs, Food &Public distribution. While the Legal Metrology Act, 2009, presented under the Central Jurisdiction, has been established as a model act, each state of India has a desire to achieve the Act with or without adjustment. In some states, as may be, have approved their own act to manage the issues and matters identified with legitimate metrology.

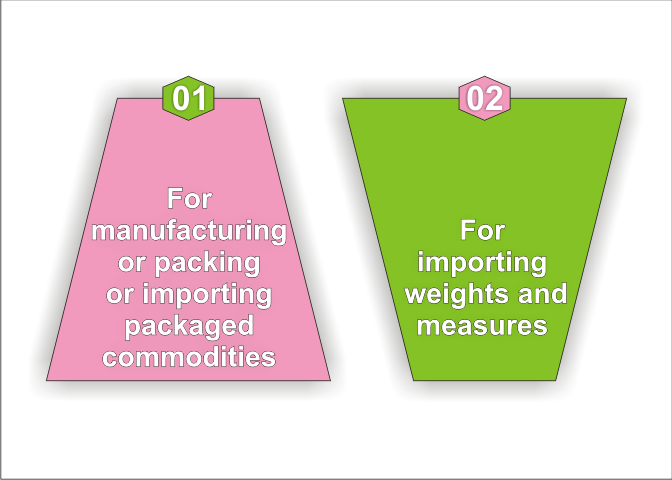

Who needs registration?

Under the Legal Metrology Act 2009 registration is done in the following cases:

- Case 1: Registration for import / manufacture / packing of packaged goods

Rule 27 of the Legal Metrology (Packaged and Commodities) Rules, 2011, makes registration mandatory for every importer, manufacturer or packaged commodities. Registration can be done with the Director of Legal Metrology of the Central Government or with the Controller of Legal Metrology of the state where the importation or coercion has ended. No matter where the registration is done, the following conditions are valid for the entire country

- Case 2: Registration for importing weights and measures

Legal Provisions

Section 19 of the Act

No person has the right to import any weight or measure if he is not registered with the director and on payment of fees, as prescribed.

Section 38

If a person is engaged in the activity of importing any weight or measure and that too without being registered under the Act, then the person will be fined which can be up to Rs 25000 for the second or subsequent offense. Is, imprisonment for a term which may extend to six months.

Registration Procedure

- Rule 15 of the Legal Metrology (General) Rules, 2011 defines the process of registration. The structure relating to fee dues is described in the Twelfth Schedule and the format related to the application is described in the Tenth Schedule to the said rules.

- Standard weights and measures or parts thereof can be imported.

- Manufacturers or vendors will be required to enroll as importers from the Director of Legal Metrology, GOI.

- A month before the import, in any case with the prescribed fee, should be submitted to the Director of Legal Controls, through the State Controller, as advice. The controller will forward the application with a report on the importer's predecessors and technical capabilities.

- The registration is valid for 5 years and is renewable.

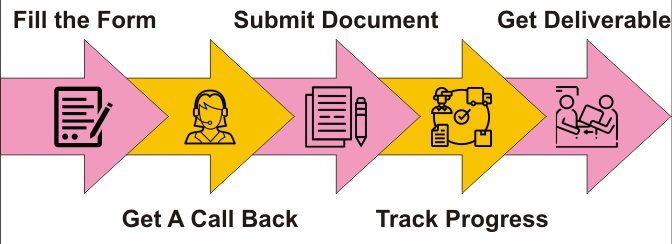

Registration Process

Guidelines for registration

Here are some guidelines that traders have to follow for registration during import / export of goods. The guidelines cover measuring weights under section 47 of the Weights and Measures Act, 1976.

- The application for the underlying registration of the name of the organization is to be added through the Controller of Legal Metrology of State / UTs for the importer of registration / weight or measurement of the exporter in which the exporter / importer is arranged with the request format Goes if Rs. 10 /- for "Pay and Accounts official" D/o Consumer Affairs, New Delhi.

- General Rules define the list of items for weight OR measure and registration shall be done only of those items.

- If it is incomplete, under notice to the applicant, give it back to the Controller of Legal Metrology within 7 days of receiving the application.

- If the application is incomplete in every case, provide the applicant with a registration certificate within 10 days of receiving the application under the copy of the Controller of Legal Metrology.

Benefits

Measurement plays an important role in business practices. It is the demand for effective trade to be transparent and strike a balance between merchants and consumers.

Modifying poor measurement practice often proves to be costly and time consuming. They affect both businesses and consumers. In fact, initiating legal action against a businessman who dare to break the measurement laws is also a high price. But when all the criteria of the Legal Metrology Act are properly and correctly followed, there is definitely a reduction in cost and time.

Legal Metrology Act is responsible for controlling any illegal and unfair trade practices. The purpose of the Act is to ensure that the measuring instruments are intact and in working condition so that they can meet their objective and meet international standards.

Government collects its revenue through excise duties imposed on products produced, sold, imported and exported and also via taxes levied on measurement. Legal Metrology Act ensures that no injustice is done to both the government and business in the matter related to payment of tax. The deal by proportion of mass items can be a huge segment of both export and national pay especially in items, for example, timber, rice, coffee, palm oil, coal, iron-mineral, gold, jewels and natural gas.

The Legal Metrology Act reduces the burden of technical constraints and promotes confidence and clarity of measurement. The low amount of barriers increases the morale of the nation and encourages them to participate in the global trade system resulting in increased national economic development. With the help of the Legal Metrology Act, a businessman can avoid the useless constraints of the adoption process, application of technical rules, standards and conformity assessment procedures.

As soon as the customer realizes that they are getting a verified product under certain rules and regulations, this will increase their confidence in the businessman which ultimately leads to a healthy business relationship.

- Reduces transaction costs

- Supporting Business

- Collecting government revenue

- Reduces Technical Barriers To Trade

- Build Consumer’s Trust

Required Documents

List of documents that the creator needs:

- Photo, identity and address proof of the applicant / partners.

- Evidence of the date of birth of the applicant / partners.

- Ownership or tenancy document of the proposed premises.

- Location Map

- In the case of partnership firms, the partnership deed.

- Model approval certificate issued by the Director, Legal Approval, Government of India, under the Legal Metrology General Rules, 2011 in relation to the proposed weight and measuring instrument.

- No Objection Certificate from Pollution Control Board, especially in Taj Trapezium Zone.

- List of machinery and equipment.

- To state that the applicant shall comply with the legal provisions and instructions issued by the Controller.

- To state that the applicant was neither punished by any court nor any criminal proceedings are pending in any court.

- Registration document of factory / shop / establishment / municipal business license, as the case may be

- Copy of VAT / CST / GST registration

- Copy of PAN

List of documents for repairer in weight and measurement:

- Proof of identity.

- Two passport sizes

- Certificate of Industry Registration

- NOC from Competent Authority.

- Document proof of ownership / lease agreement of the documents.

- In the case of a proprietary / partnership firm, the Constitution. Documents registered in the case of a company register certificate under the Companies Act along with a copy of the Articles of Association and Memorandum of Association.

- Employee Copies of Appointment Letters with photographs, Qualification and Experience Certificate, if any;

- Machinery, equipment and accessories list with purchase bill.

- Trial weight purchase bill in case of new verification certificate.

- GST Registration Certificate.

- Professional Tax Registration Certificate

- Valid labor license.

License for dealer in weights and measures:

- Machinery, equipment and accessories list with purchase bill.

- Trial weight purchase bill in case of new verification certificate.

- GST Registration Certificate.

- Professional Tax Registration Certificate

- Valid labor license.

License for dealer in weights and measures:

- Identity & Residential Proof.

- Two Passport size.

- Letter of Consent from the Manufacturer who wish to appoint you as a Dealer

- Manufacturing Licence if you intend to import weights & measures from outside the State.

- Model Approval Certificate of weights and measures to be deal with.

- Documentary proof of ownership / Lease agreement of Premises.

- GST Registration / Professional Tax / Labour Licence

Functions of Legal Metrology Act Registration

Accuracy and precision plays an important role in measurement. A straightforward and efficient legal metrology framework relies on trade, industry and the buyer and through

brings the agreed-upon status to the dominant business.

- Commitment to the nation's economy by expanding income across various divisions.

- In coal, mines, industries, petroleum, railways is assuming significant work in reducing revenue loss.

- Reducing the amount of losses and wastage in the infrastructure sector.

The work done by legal metrology is important to the public interest. The Executive, Legal Metrology is a statutory authority to support the inter-state trade and forces and duties related to the trade of measures including weights and pre-packaged products under the Legal Metrology Act, 2009. The Director, Legal Metrology is similarly responsible for the creation of standards of legal metrology and for maintaining the identity of the standards of legal metrology. The essential duties of the Director are in the consideration of regulation, enforcement and research, regulation and enforcement capabilities to attempt the investigation, look, seizure, enforcement of workplaces and inducement indices in a particular area.

How Servzone will help you?

GST Registration

PVT. LTD. Company

Loan

Insurance